Certain changes proposed by the 2023 Budget will have the effect of expanding the scope and impact of Alternative Minimum Tax (“AMT”).

What is AMT?

Simply put, it is an alternative calculation of an individual’s tax payable balance. Essentially, there is the set of the regular calculations that every individual taxpayer that files a return is familiar with to some degree, and a much less well known alternative calculation for AMT purposes. To the extent the tax payable under the alternative calculation exceeds the tax payable under the regular calculations, the excess is an additional tax payable as AMT. There is potentially some relief in that AMT is recoverable in future years, depending on the facts, but it is not certain.

Currently, by far the most common scenario where AMT is payable is upon the use of the capital gains exemption. A taxpayer will sell property eligible for the exemption (such as small business corporation shares or qualified farming or fishing property) for an amount less than $1m and expect, perhaps from their own research or perhaps speaking with an advisor, to pay ‘no tax’ on the transaction, and are surprised when their accountant calls and advises them that there is a ‘catch’ to the free lunch they thought they were getting – and that they owe tens of thousands of dollars of AMT.

The changes proposed in Budget 2023 will continue to impact such transactions, but they will also have the effect of bringing many more taxpayers into situations where they are required to pay AMT.

What changes to AMT are proposed?

- An increase of the rate used to calculate AMT (and by extension Ontario AMT since Ontario AMT is a percentage of federal) from 15% federally to 20.5% federally.

- An increase to the basic exemption from AMT from $40,000 in 2023 to $173,000 for 2024.

- Significant changes to the calculation of Adjusted Taxable Income (which is essentially taxable income for AMT purposes) including:

- Increasing the capital gains inclusion rate from 80% to 100%

- Decreasing the capital loss carryover inclusion rate from 80% to 50%

- Increasing the inclusion rate for capital gains on donations of publicly listed securities from 0% to 30%

- Increasing the inclusion rate for employee stock option benefits to 100% (from as low as 50%)

- Disallowing, for AMT purposes, 50% of many deductions including:

- interest and carrying charges on property income

- non-capital loss carryovers

- most employment expenses

- moving expenses

- limited partnership loss carryovers

- Disallowing, for AMT purposes, 50% of most personal tax credits

Those items, taken on their own, may not jump off the page in terms of their real world application, but imagine a taxpayer with no other income who experiences a $2m capital loss in a year, and then a $2m capital gain in the following year. In the past, no tax was payable by this taxpayer because the loss was incurred in the first year and then used to reduce taxable income in the second year so no tax was payable under the ‘regular’ calculations of tax payable, and no AMT was payable either because the calculation of income for AMT purposes effectively included 80% of the gain for AMT purposes and allowed 80% of the loss, a net zero. Budget 2023 proposes, however, as noted above, to include 100% of the gain into income for AMT purposes, while only allowing 50% of the loss. The net result in 2024 is proposed to be a $1m ($2m-$1m) inclusion for AMT purposes, and tens of thousands of dollars of AMT to pay; its difficult to understand why a taxpayer with no income over a two year period should face that obligation.

What are some other new situations in which AMT might apply in 2024?

We expect the most common such situation will be that of a taxpayer who experiences a large capital gain (whether or not the gain is eligible for the capital gains exemption).

Why is that the case? Between the federal AMT, the basic Ontario AMT, and the additional surtaxes that are part of the calculation of the Ontario AMT, the proposals will result in a top marginal rate on Adjusted Taxable Income will be 31.3% and that is before any disallowed expenses, credits, and other nuances of the calculation – the actual rate experienced by a taxpayer may be considerably higher. Currently, the top marginal rate in Ontario on capital gains is 26.76%. As a result, despite the higher basic exemption contained in the proposals, as capital gains increase, the amount of AMT payable increases, and the marginal rate experienced by the taxpayer (before disallowed credits and expenses) converges towards 31.3%.

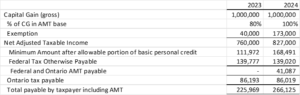

Illustration – $1,000,000 Capital Gain in Ontario

Consider a single taxpayer in Ontario with a $1m capital gain, no other sources of income, and only the basic personal credit. We expect the following approximate result based on the proposals (and based on certain assumptions about tax brackets for 2023 and 2024, etc):

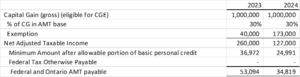

Illustration – $1,000,000 Capital Gain eligible for Capital Gains Exemption in Ontario

Interestingly, and perhaps counter-intuitively given the above discussion, that same taxpayer with a $1m capital gain eligible for the capital gains exemption, will actually pay less AMT in 2024 (based again on certain assumptions):

Family Trusts and Non-Graduated-Rate Estates

Consider also a discretionary family trust or non-GRE estate that holds investments and has borrowing expenses – either in respect of a bank loan, or carrying charges, or perhaps even from a prescribed rate loan. Assuming the trust annually earns $100,000 of investment income, has a $100,000 in interest expenses, and no other income or expenses. Due to 50% of the interest deduction being disallowed for AMT purposes and due to trusts not having access to the basic AMT exemption, the trust can expect to pay AMT every year from 2024 forward, despite the fact that the trust has no taxable income and despite the fact that trusts are already taxed at the highest marginal rate.

Hopefully this apparent inequity will be addressed before these proposals are enacted.

Salary, interest, and dividends

Taxpayers earning only these types of income should have limited or no AMT considerations despite the dividend credit being fully disallowed for AMT purposes as the marginal rates on these types of income should exceed rates marginal rates for AMT purposes.

Conclusions

Many more taxpayers can expect to pay AMT in 2024 and forward, based on the current proposals. These amounts payable may sometimes be a shock to the taxpayer and may not always have clear policy reasons behind them.

Modelling of future income tax returns will become more important in future years to avoid surprises, particularly in years where large capital gains are expected, where stock option benefits or donations of publicly listed securities are expected, and where disallowed credits and deductions for AMT purposes will have a significant impact.

It is important to note that although the first portion of the changes from the 2023 Budget are legally effective as of the writing of this memorandum, other changes proposed in the Budget, including the changes to the AMT regime discussed herein, are not yet law and are subject to change.

We will be happy to assist you with navigating the impact of these proposals.

For more information, please contact:

Dan L. Maresca, CPA, CA

Tax Partner

EMAIL [email protected]

CALL +1 778 242 2168